Need Social Security Disability Help in Iowa? Learn How To Qualify For SSDI or SSI From Iowa’s Social Security Disability Attorneys

If you’ve become disabled and are unable to work, you may be eligible for Social Security Disability benefits (SSD) through the Social Security Administration (SSA). These benefits can provide financial support while you navigate life with a disability.

However, applying for SSD benefits can be a complex process that requires proper documentation, attention to detail, and, sometimes, legal assistance.

What Is Social Security Disability?

Social Security Disability (SSD) is a federal program that provides benefits to people who are unable to work due to disability. The program is designed to help individuals who have paid into the system through payroll taxes over the years and now need assistance because of a disability.

SSD benefits are meant to replace your income when you can no longer earn money due to physical or mental impairments.

Two primary programs fall under Social Security Disability:

- Social Security Disability Insurance (SSDI): For individuals who have worked and paid Social Security taxes for a certain number of years.

- Supplemental Security Income (SSI): For individuals who are disabled and have low income and limited resources, regardless of their work history.

How To Qualify For Social Security Disability Benefits In Iowa

To qualify for SSD benefits, you must meet specific requirements. The SSA evaluates your claim based on the following criteria:

- Work History: For SSDI, you must have worked for a certain number of years and paid Social Security taxes. Typically, you need to have worked for at least five out of the last 10 years. For younger workers, fewer work credits may be required.

- Severe Disability: You must have a severe medical condition that prevents you from doing substantial gainful work. This includes conditions like heart disease, cancer, musculoskeletal disorders, mental health conditions, and more.

- Duration of Disability: Your disability must be expected to last at least one year or result in death.

- Earnings Limit: You must not be earning more than a certain amount per month. As of 2025, the monthly earnings limit is $1620 for non-blind individuals and $2,700 for blind individuals.

The Five-Step Evaluation For Iowa Social Security Disability Claims

The SSA uses a five-step process to determine if you are eligible for disability benefits. This is the same process used in all states, but it’s important to understand the steps as they apply to your situation in Iowa:

- Are you working? If you are earning more than the SSA’s earnings limit, you will not qualify for SSD.

- Is your condition severe? The SSA evaluates whether your medical condition is severe enough to limit your ability to perform basic work-related tasks.

- Is your condition on the list? The SSA has a list of impairments, known as the Listing of Impairments. If your condition is listed, it may automatically qualify you for benefits.

- Can you do the work you did before? If you can still perform the type of work you did previously, you may not be eligible for benefits.

- Can you do any other type of work? If you are unable to do your previous job, the SSA evaluates whether you can perform another type of work that fits your age, education, and experience.

The Role Of An Iowa Disability Lawyer

Social Security Disability law can be complex, and many claims are initially denied. An experienced Iowa Social Security Disability attorney can guide you through the application process, handle necessary paperwork, represent you at hearings, and increase your chances of securing benefits.

Steps To Apply For Social Security Disability Benefits In Iowa

Applying for Social Security Disability benefits in Iowa involves several steps, which can take several months or even years.

Here’s how to apply:

- Gather Medical Evidence: The SSA requires detailed medical records to prove the severity of your condition. These may include hospital records, doctor’s notes, test results, and prescriptions.

- File Your Application: You can apply online through the SSA website or at your local Social Security office. If you are planning to apply with the local office, you must have an appointment. You will need to provide personal information, work history, and medical history.

- Wait for a Decision: Once your application is submitted, the SSA will review your case and decide whether to approve or deny your claim. This can take several months.

- Request a Hearing: If your claim is denied, you can request a hearing with an Administrative Law Judge (ALJ). A hearing may take months to schedule, but an attorney can help prepare your case and represent you at the hearing.

- Receive a Decision: After the hearing, the ALJ will make a final decision. If your claim is approved, you will begin receiving benefits. If your claim is denied, you can appeal further to the Appeals Council.

How An Iowa Social Security Disability Attorney Can Help You

Navigating the Social Security Disability process can be overwhelming. Here’s how an experienced Iowa attorney can assist you:

- Help You Understand Your Eligibility: An attorney can evaluate your medical condition and work history to determine if you meet the requirements for SSD or SSI benefits.

- Prepare Your Application: An attorney can ensure that your application is filled out correctly, with all necessary documentation and medical evidence.

- Represent You at a Hearing: If your claim is denied, an attorney can represent you at your ALJ hearing, presenting your case and advocating for your rights.

- Handle Appeals: If your claim is denied at any stage, an attorney can help you file an appeal, ensuring you take the necessary steps to continue your fight for benefits.

Iowa Social Security Disability Appeal Claims Process

If your Social Security Disability claim is denied in Iowa, you have several options for appealing the decision:

- Reconsideration:

This is the first level of appeal. A different claims examiner will review your case and determine if the initial decision should be changed. This process can take several months. - Hearing by an Administrative Law Judge (ALJ):

If reconsideration is denied, you can request a hearing in front of an ALJ. At this stage, you can present new evidence, call witnesses, and argue your case before a judge. - Appeals Council:

If the ALJ denies your claim, you can ask the Appeals Council to review the decision. They can either agree with the ALJ’s decision, send the case back for a new hearing, or overturn the decision. - Federal Court:

If all other options have been exhausted, you may file a lawsuit in federal court.

Understanding The Differences Between SSDI and SSI Benefits

When applying for Social Security Disability benefits in Iowa, it’s important to understand that there are two main programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

These programs are both administered by the Social Security Administration (SSA), but they have different eligibility requirements and purposes.

Below is a breakdown of both programs:

Social Security Disability Insurance (SSDI)

SSDI is a program for individuals who have worked and paid Social Security taxes. It is meant to provide financial assistance to those who are no longer able to work due to a disability but have contributed to the Social Security system through their earnings.

Key Eligibility Requirements For SSDI:

- Work History and Social Security Credits: To qualify for SSDI, you must have worked a certain number of years and paid into the Social Security system through payroll taxes. This is done by earning Social Security credits.

- Work Credits: You earn one credit for every quarter you work and pay Social Security taxes. In 2025, you need to earn $1,810 to get one credit. You can earn up to four credits per year.

- Number of Credits Needed: Generally, you need 40 credits, with 20 of those credits earned in the last 10 years. For younger workers, fewer credits may be required, depending on their age at the time of disability.

- Disability Criteria: To be eligible for SSDI, you must have a medical condition that is severe enough to prevent you from working and that is expected to last for at least one year or result in death. The condition must meet the SSA’s definition of “disability.”

- Substantial Gainful Activity (SGA): SSDI applicants must prove that they are not engaging in Substantial Gainful Activity (SGA). SGA refers to earnings above a certain amount. As of 2025, the SSA considers monthly earnings above $1,620 for non-blind individuals to be too high for SSDI eligibility.

Benefits Under SSDI:

- The amount of SSDI benefits you receive depends on your past earnings. The SSA uses a formula to determine the monthly amount you are eligible for based on your lifetime average earnings.

- If you qualify for SSDI, your benefits are paid monthly and can last for as long as you are disabled.

Supplemental Security Income (SSI)

SSI is a needs-based program designed for individuals with disabilities who have little or no income and resources.

Unlike SSDI, SSI does not require a work history or the payment of Social Security taxes. Instead, it is designed to help those who are financially needy and disabled.

Key Eligibility Requirements For SSI:

- Financial Need: SSI is a needs-based program, meaning that your income and resources must be below certain thresholds.

In 2025, to qualify for SSI, you must have:

- An income below the federal poverty level, which varies based on your living situation.

- Resources of no more than $2,000 if you are single, or $3,000 if you are married. Resources include cash, bank accounts, and other assets. Certain assets, like a home or car, may not be counted.

- Disability Criteria: SSI eligibility also requires that the applicant meet the SSA’s definition of disability. The condition must prevent the individual from performing substantial work and must be expected to last at least one year or result in death.

- No Work History Required: Unlike SSDI, there are no work history requirements for SSI. You can qualify for SSI regardless of whether you have worked or paid into Social Security, as long as you meet the financial need criteria.

Benefits Under SSI:

- The monthly benefit amount for SSI is standardized across the United States and is based on the federal benefit rate, which is adjusted for inflation each year. As of 2025, the maximum federal benefit rate for SSI is $967 per month for individuals and $1,450 per month for couples.

- If you receive SSI, you may also be eligible for Medicaid in Iowa, which helps cover medical expenses.

Key Differences Between SSDI and SSI

Here is a quick summary of the key differences between SSDI and SSI to help you determine which program may be right for you:

| Criteria | SSDI | SSI |

|---|---|---|

| Eligibility | Requires work history and Social Security credits | Based on financial need and disability alone |

| Work History Requirement | Yes, must have paid into the Social Security system | No work history required |

| Income Limit | No income limit, but earnings must be below SGA | Must have limited income and resources |

| Resource Limit | N/A (depends on work history and earnings) | Must have resources below $2,000 (single) or $3,000 (married) |

| Benefits Based On | Past earnings (calculated using a formula) | Federal benefit rate, typically lower than SSDI |

| Medical Requirement | Must be disabled and meet SSA’s criteria | Must be disabled and meet SSA’s criteria |

Qualifying For Both SSDI and SSI At The Same Time (Concurrent Benefits)

Some individuals may be eligible for both SSDI and SSI benefits, which are known as concurrent benefits. This can happen if:

- You qualify for SSDI based on your work history, but your monthly SSDI benefits are too low (due to limited earnings) to cover your basic living expenses.

- You have low income and limited resources, so you also qualify for SSI.

In this case, you would receive the SSDI benefits you are entitled to, along with the additional SSI benefits to bring your total monthly benefits up to the federal benefit rate.

How To Qualify For Concurrent Benefits In Iowa

- SSDI Eligibility: If you meet the work history and disability criteria for SSDI, but your monthly SSDI benefit is less than the federal benefit rate, you may qualify for SSI.

- SSI Eligibility: You must meet the income and resource limits for SSI to receive the additional benefit.

An Iowa Social Security Disability attorney can help you determine whether you qualify for both programs and ensure you receive the maximum benefits you are entitled to.

Frequently Asked Questions (FAQs)

Q: How long do I have to wait for Social Security Disability benefits in Iowa?

A: The process for receiving disability benefits can take a long time. After you apply, it may take 3 to 7 months to receive an initial decision. If your claim is denied, you have the right to appeal and request “reconsideration”. It can take an additional 3-7 months to receive the decision at “reconsideration”. If denied again, you will need to appeal and request a hearing, it could take an additional 6 to 9 months for a hearing and decision.

Q: Can disabled Iowans apply for Social Security Disability if they’re still working?

A: You can still apply for Social Security Disability if you’re working, but you must earn less than the Substantial Gainful Activity (SGA) limit set by the SSA. For 2025, the monthly earnings limit is $1,470 for non-blind individuals.

Q: Can I apply for Social Security Disability benefits if I have a pre-existing condition?

A: Yes, you can apply for SSD benefits even if you have a pre-existing condition. However, your condition must meet the SSA’s definition of disability, meaning it must prevent you from working and last at least one year or result in death.

Q: Can Iowa attorneys help me with my SSD application?

A: Yes, an attorney can help you with your SSD application. They can ensure that your application is completed correctly, all necessary documentation is included, and your social security disability case is presented in the best possible light. An attorney can also represent you if your claim is denied.

Q: What happens if my Social Security Disability claim is denied in Iowa?

A: If your claim is denied, you have the right to appeal the decision. The first step is to request reconsideration. If reconsideration is denied, you can request a hearing in front of an Administrative Law Judge. If that decision is unfavorable, you can continue to appeal up to the federal court.

Tim Semelroth

Board-Certified Trial Attorney

Pressley Henningsen

AV-Rated Trial Attorney

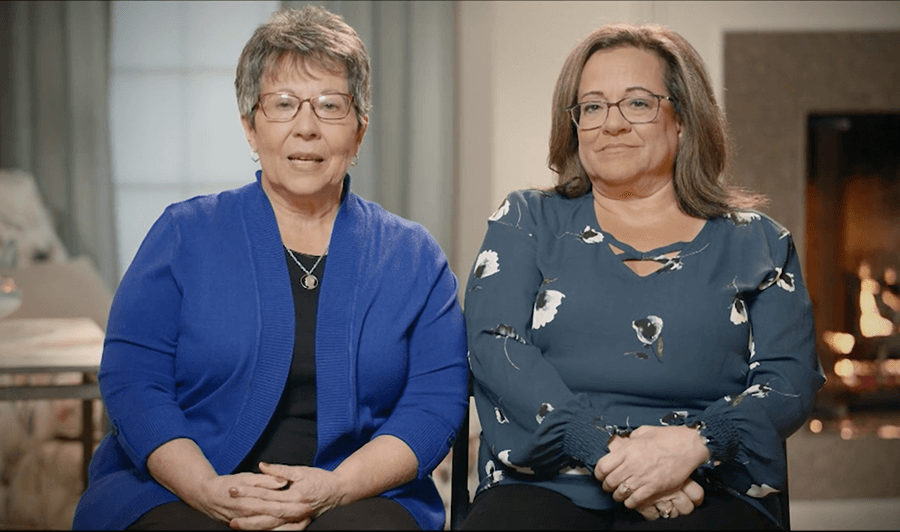

A car came through the median and we were hit head on. Every bone in my body from my lower jaw down to the bottom of my feet was broken. My medical bills were in the hundreds of thousands of dollars. I can’t imagine going through something like this without someone like Tim or RSH Legal.

See more Client ReviewsClient Reviews